The Child Tax Credit in the American Rescue Plan (ARP) Act provides the largest Child Tax Credit ever to America’s working families. Most families will automatically receive monthly payments without having to take any action. As a grantee, we would like your help as we work to raise awareness of this significant tax relief for working families.

Let’s help families learn about the Child Tax Credit! Many families served by our programs are eligible for this crucial benefit that experts estimate will cut child poverty in half. Roughly 39 million households—covering 65 million children (nearly 90% of children in the United States)—will automatically receive the new Child Tax Credit. We want to make sure all eligible families sign up for the benefit.

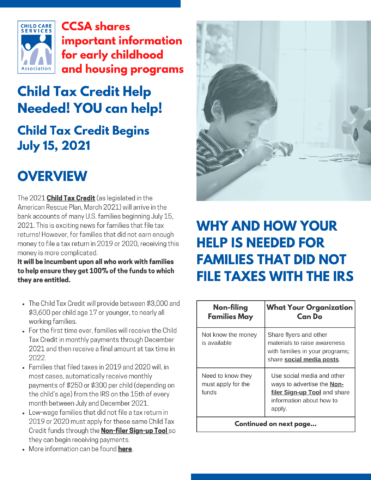

Please note that non-tax-filer parents can receive the July 2021 Child Tax Credit payment. Even if they did not file a 2019 or 2020 income tax return, they might still qualify for the new Child Tax Credit for up to $3,600 per child. These families may need more targeted outreach and education about the payment.

Child Care Services Association (CCSA) prepared this step-by-step paper that shares ways to help! We hope early childhood programs and housing programs will work with families to help them receive this crucial funding. Please assist us in making sure families that did not file taxes last year know how to use the IRS’s Child Tax Credit Non-filer Sign-up Tool to apply for the benefits.