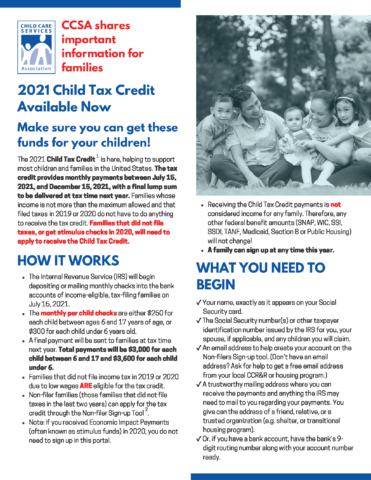

The 2021 Child Tax Credit is here, helping to support most children and families in the United States. The tax credit provides monthly payments between July 15, 2021, and December 15, 2021, with a final lump sum to be delivered at tax time next year. Families whose income is not more than the maximum allowed and that filed taxes in 2019 or 2020 do not have to do anything to receive the tax credit. Families that did not file taxes, or get stimulus checks in 2020, will need to apply to receive the Child Tax Credit.

CCSA prepared this step-by-step guide for families in English, Spanish, French, Vietnamese, Korean, Arabic, Bengali and Gujarati to ensure they receive the Child Tax Credit for their children.

Thank you to Cetra for the translations.